It is institutional fraud, across the board and directed at the average consumer, that had elevated the issue of the new consumer protection agency to a grassroots level to begin with.Wells Fargo Overdraft Scam Makes Elizabeth Warren More Important Than Ever

A landmark court ruling on Wells Fargo's outrageous overdraft scam has the potential to return hundreds of millions of dollars in stolen funds to consumers all over the country. But like many of the banking scandals from the past decade, there's more to the story than simple bank predation. When banks devised this new program to swindle their own customers, bank regulators did not merely look the other way, they actively encouraged the behavior by writing a new rule approving a practice that courts now believe to be unfair and deceptive. The Wells Fargo case should be viewed as a clear example of why Elizabeth Warren ought to head the new Consumer Financial Protection Bureau.

The overdraft scam that Judge William Alsup slapped down yesterday is not unique to Wells Fargo-- every big bank in the country has been doing it for years, and if it's never happened to you, it's probably happened to your friends or family. Banks make a lot of money from overdraft fees-- $38 billion last year, compared to a combined industry profit of just $12.5 billion. They don't make that money by accident. Internal company emails and memos from the Wells Fargo case show bankers spending a lot of time figuring out how to maximize the number of overdraft charges they can hit their checking customers with.

One way is by changing the order in which your transactions are processed. Most people think that their checks and debit card purchases are processed in the order that they make them. But that's not how banks actually do it. Instead, they wait for you to make several purchases, and then process the most expensive purchases first. This method pushes a customer's balance to zero faster than the honest way that actually reflects buying habits. And the sooner your balance goes to zero, the more overdraft fees the bank can hit you with.

And it is not just the bank customers that are institutionally screwed over by the financial system. Again from Mr. Carter, even the small players on Wall Street are habitutally hammered to the benefit of the American elite that continues to escape punishment for their crimes:

Cindy Sheehan wrote a particualrly prescient piece recently that drives home the truth as it has always been known to too many of us:Will Anyone Be Punished For Citibank's $40 Billion Subprime Lie?

Finally, some good news on Wall Street accountability. A federal judge is holding up the SEC's effort to let Citigroup's top executives off the hook for misleading their own shareholders about $40 billion in subprime debt.

If Citi executives did what the SEC says they did, then the company's top managers are guilty of both civil and criminal fraud. But regulator isn't even going after some of the executives, while letting others off with a penalty that amounts to a rounding error on their bonuses. The proposed settlement is a stunning and shameful declaration of deference to the nation's top financiers, a literal get-out-of-jail free card for bankers who not only wrecked the economy, but—according to SEC allegations—broke the law to do it.

I, and too many others, have noted many times that we appear to be a Plutocracy that has already fallen into a kleptocracy (witness the generational theft that is the bailouts). This is taken from a post on the bailouts and how they were not helping the average Americans (nor democracy) at all:Racketeers for Capitalism

"I spent 33 years in the Marines. Most of my time being a high-class muscle man for Big Business, for Wall Street and the bankers. In short, I was a racketeer for capitalism."

Major General Smedley D. Butler, War is a Racket (1935)

...snip...

As little as we hear about U.S. troops, as is our custom here in the Empire, the tragic slaughter of civilians in Iraq, Afghanistan and Pakistan doesn't even deserve a blip on our radar screens. I watched three hours of MSDNC (MSNBC) tonight and the manipulative gyrations to find out how many ways that they could talk about the "distraction" of the "mosque" at ground zero without talking about the one-million plus Arabs (Christians, Muslims, Jews, etc) that the psychopathic U.S. response to September 11, 2001 has killed, was pathetic and frustrating to watch.

There has been a bumper sticker saying for years that goes: "What if they gave a war and no one showed up?"

Well, "they," the ones that give the wars are not going to stop. "They" have too much at stake to give up the cash cow of wars for Imperial Profit, Power, and Expansion. "They" use the toady media to whip up nationalistic and patriotic fervor to get our kids to be thrown together with the victims in a meat grinder of destruction and we just sit here and allow them to do it.

The Empire preys on our kids using all the tools at its disposal: Economic panic, high college tuition, high unemployment and a mythology that the U.S. has some existential right to steal the resources of other nations.

It is worth revisiting that piece both for the post and the comments that followed here and at other Blogs, as well as other reactions to the discussed news articles of the day across the Blogosphere:Everything you need to know about the bailouts

in 2 short paragraphs. A relatively long post for Atrios. Wheeeeeeeeeeeeee!

What's The Goal?Meanwhile a fire sale is going on:

Others have made this point in various ways, but if the goal is to bail out the banksters and keep the existing too big to fail financial order in place with the same cast of characters in charge, then all of this sounds like a cunning plan.

If the goal was really to get banks lending again they'd be funneling large sums of money to healthy (mostly smaller) financial institutions who actually made sensible choices over the last few years.

Lenders have become so overwhelmed by the foreclosure crisis that they are starting to unload properties in bulk to investor groups at steep discounts.Citi left a 100 grand on the table. This looks like a great way to abuse the taxpayer even more.

Investors then flip the properties for a profit without necessarily improving the home.

For example, a unit of Citigroup, the troubled financial giant, sold a foreclosure in Temecula to an Arizona investment firm for $139,000 when comparable homes in the area were selling for $240,000 to $260,000.

The firm listed the home for $249,000, received multiple offers and the property has entered escrow, said Amber Schlieder, the real estate agent who handled the listing.

I want to know who they are all selling in bulk to.

Remember who else was buying up the mortgages in bulk?

So it may come as a surprise that a dozen former top Countrywide executives now stand to make millions from the home mortgage mess.The Treasury has shown a willingness to recklessly toss all of our futures away to keep these "Too Big Failures" operating in their self-entitled comfort zone.

Stanford L. Kurland, Countrywide's former president, and his team have been buying up delinquent home mortgages that the government took over from other failed banks, sometimes for pennies on the dollar. They get a piece of what they can collect.

"It has been very successful - very strong," John Lawrence, the company's head of loan servicing, told Mr. Kurland one recent morning in a glass-walled boardroom here at PennyMac's spacious headquarters, opened last year in the same Los Angeles suburb where Countrywide once flourished.

We had this discussion over at MLN (greenpeas brought it to our attention in comments).At the time that we, here at ePluribus Media, and MLN and too many others places were having these dicussions, buddydarhma wrote what I thought was an outstanding post on this at dKos

Plutocracy is a better description of our situation, IMHO. A Plutocracy that has collapsed into a Kleptocracy, given the Robber Baron Banks... The oligarchy is just a part of our plutocracy:

In a plutocracy, the degree of economic inequality is high while the level of social mobility is low. This can apply to a multitude of government systems, as the key elements of plutocracy transcend and often occur concurrently with the features of those systems.But I do understand that either oligarchy and plutocracy might be used almost interchangeably in these times.

The word plutocracy is derived from the ancient Greek root ploutos, meaning wealth and kratein, meaning to rule or to govern.

The term plutocracy is generally used to describe two distinct concepts: one of a historical nature and one of a modern political nature. The former indicates the political control of the state by an oligarchy of the wealthy. Examples of such plutocracies include some city-states in Ancient Greece, the civilization of Carthage, the Italian merchant republics of Venice and Florence, and Genoa.

Kevin Phillips, author and political strategist to U.S. President Richard Nixon, argues that the United States is a plutocracy in which there is a "fusion of money and government."

snip

A Plutocracy is a government controlled by a minuscule proportion of extremely wealthy individuals found in most societies. In many forms of government, those in power benefit financially, sometimes enough to belong to the aforementioned wealthy class.

Classically, a plutocracy was an oligarchy, which is to say a government controlled by the wealthy few. Usually this meant that these 'plutocrats' controlled the executive, legislative and judicial aspects of government, the armed forces, and most of the natural resources. To a certain degree, there are still some situations in which private corporations and wealthy individuals may exert such strong influence on governments, that the effect can arguably be compared to a plutocracy.

If there are no forms of control within the society, the plutocracy can easily collapse into a kleptocracy, "reign of thieves", where the powerholders attempt to confiscate as much public funds as possible as their private property. A kleptocratic state is usually thoroughly corrupt, has very little production and its economy is unstable. Many failed states represent kleptocracies.

http://en.wikipedia.org/wiki/P...

Oligarchy is a form of government where political power effectively rests with a small elite segment of society distinguished by royalty, wealth, family, military powers or occult spiritual hegemony. The word oligarchy is from the Greek words for "few" and "rule".greenpeas: "In terms of how he thinks the situation should be handled, he is in favor of breaking the banks up into much smaller entities and letting them prey upon themselves essentially. Sound diabolical enough for ya? (grin)"

Early societies may have become oligarchies as an outgrowth of an alliance between rival tribal chieftains or as the result of a caste system. Oligarchies can often become instruments of transformation, by insisting that monarchs or dictators share power, thereby opening the door to power-sharing by other elements of society (while oligarchy means "the rule of the few," monarchy means "the rule of the one"). One example of power-sharing from one person to a larger group of persons occurred when English nobles banded together in 1215 to force a reluctant King John of England to sign the Magna Carta, a tacit recognition both of King John's waning political power and of the existence of an incipient oligarchy (the nobility). As English society continued to grow and develop, Magna Carta was repeatedly revised (1216, 1217, and 1225), guaranteeing greater rights to greater numbers of people, thus setting the stage for English constitutional monarchy. Oligarchy is also compared with Aristocracy and Communism. In an aristocracy, a small group of wealthy or socially prominent citizens control the government. Members of this high social class claim to be, or are considered by others to be, superior to the other people because of family ties, social rank, wealth, or religious affiliation. The word "aristocracy" comes from the Greek term meaning rule by the best. Many aristocrats have inherited titles of nobility such as duke or baron.

snip

Capitalism as a social system is sometimes described as an oligarchy. Socialists argue that in a capitalist society, power - economic, cultural and political - rests in the hands of the capitalist class. Communist states have also been seen as oligarchies, being ruled by a class with special privileges, the nomenklatura.

http://en.wikipedia.org/wiki/O...

As for this part? It will have to be done in some way. I think they should be nationalized, clean sweep of the gambling junkies, broken up into "small enough to fail" banks, and then they could be returned to a well regulated market. Originally I had said "let them fail", but the problem with that that took me a while to realize was that if they were just "left to fail" you could add trillions more of losses to the credit derivatives gambling tables making this even worse.

And you can add this to the list of things to do: prosecution and litigation for any criminal and criminally negligent activities.

My beef above with oligarchy is more a matter of a technicality in the actual definition of our society. We have so much more than just a ruling elite. Our politicians profit from their legislation in favor of the oligarchy, etc., corporations, companies and the upper middle class (the lower uber rich?) that have the money to invest - and aren't really part of the true oligarchy - also profit from these manipulations. The rest of "us" pay the price for this selling out. I am sure most of you can recognize the difference and similarities in the two definitions and decide for yourselves.

It sure is somewhat gobsmacking to see and hear an insider talk like this. As greenpeas put it: "This is somebody with what I would consider very insider, accepted connections - Sloan School of Management, Peterson Institute - saying the situation sucks big time."

Thanks for writing this up... I can check one thing off of my own "too-much-to-do list" now. lol

Some extra food for thought:The fact is that the entire political system is so rigged against the average American that not only have the elite successfully robbed us to bail themselves out... They have managed to pass through this entire mess they created without even barely a scratch. IOW:

Hard Not To Call It EvilRead on...

According to people who should know, The Ruling Class is using our money....draining our money, the money we use to survive and feed our children and to actual produce things, to rescue the very structure...that allows them to BE The Ruling Class. The structures that enable them to Rule us by controlling credit, capital, and our pensions and IRA's and 401k's.

And our regulatory agencies and politicians. And so by extension our military. Which is then used in the service and interests of The Ruling Class and their Party of Business, the GOP.

These people, the Ruling Class, are the ones who got us into this financial armageddon. These are the same Ruling Class that took us to war in Iraq, after ignoring the warnings that an attack was coming.

They are the same people who made America into a nation that tortures people they KNOW to be innocent. They are the same people...if they even deserve the name...who are stopping any serious efforts to mitigate a Climate Crisis of incomprehensible scope.

They are the same people that so unprecedentedly had the Supreme Court decide Bush vs. Gore, so they could have Bush cut their taxes and deregulate the very same structures that we are now being called to give OUR money to prop up. Yes, the very same people who are directly responsible for everything that has gone wrong in our world, are the people who are now telling us....not asking us....telling us, that we have to bail them out. While as always, not telling us the whole story, not telling us what they are doing behind the scenes and behind our backs.

We have gone from a failing Plutocracy to Kleptocracy and ridden right back into a new age of Plutocracy that has, IMHO, actually gained a stronger grip on Americans and our politics:

From Digby, and I hope she forgives me for stealing the entire thing because it is noteworthy:

The truth is that it is not really back to normal.Plutonomy Revival

We've been hearing a lot lately about how we have to coddle the wealthy or they'll hold their breath until they turn blue and then we'll be in real trouble. It seems ridiculous that anyone would listen to this, but it's worth revisiting this Wall Street Journal piece from 2007 to get an idea of where this is coming from:

It’s well known that the rich have an outsized influence on the economy.Keep in mind that from atop the rubble of the economic meltdown, those very people are once again making big bucks and lobbying strongly for less regulation whiloe they cry about being demonized in the press. (And it is those same people who are telling congressmen, many of whom are also in the upper one percent, that they have plenty of jobs, but the unemployed are too lazy to take them.)

The nation’s top 1% of households own more than half the nation’s stocks, according to the Federal Reserve. They also control more than $16 trillion in wealth — more than the bottom 90%.

Yet a new body of research from Citigroup suggests that the rich have other, more-surprising impacts on the economy.

Ajay Kapur, global strategist at Citigroup, and his research team came up with the term “Plutonomy” in 2005 to describe a country that is defined by massive income and wealth inequality. According to their definition, the U.S. is a Plutonomy, along with the U.K., Canada and Australia.

In a series of research notes over the past year, Kapur and his team explained that Plutonomies have three basic characteristics.

1. They are all created by “disruptive technology-driven productivity gains, creative financial innovation, capitalist friendly cooperative governments, immigrants…the rule of law and patenting inventions. Often these wealth waves involve great complexity exploited best by the rich and educated of the time.”

2. There is no “average” consumer in Plutonomies. There is only the rich “and everyone else.” The rich account for a disproportionate chunk of the economy, while the non-rich account for “surprisingly small bites of the national pie.” Kapur estimates that in 2005, the richest 20% may have been responsible for 60% of total spending.

3. Plutonomies are likely to grow in the future, fed by capitalist-friendly governments, more technology-driven productivity and globalization.

Kapur says that once we understand the Plutonomy, we can solve some of the recent mysteries of the American economy. For instance, some economists have been puzzled (especially last year) about why wild swings in oil prices have had only muted effects on consumer spending.

Kapur’s explanation: the Plutonomy. Since the rich don’t care about higher oil prices, and they dominate spending, higher oil prices don’t matter as much to total consumer spending.

The Plutonomy also could explain larger “imbalances” such as the national debt level. The rich are so comfortably rich, Kapur explains, that they have started spending higher shares of their incomes on luxuries. They borrow much larger amounts than the “average consumer,” so they have an exaggerated impact on the nation’s debt levels and savings rates. Yet because the rich still have plenty of wealth and healthy balance sheets, their borrowing shouldn’t be a cause for concern.

In other words, much of the nation’s lower savings rate is due to borrowing by the rich. So we should worry less about the “over-stretched” average consumer.

Finally, the Plutonomy helps explain why companies that serve the rich are posting some of the strongest growth and profits these days.

“The Plutonomy is here, is going to get stronger, its membership swelling” he wrote in one research note. “Toys for the wealthy have pricing power, and staying power.”

If you think plutonomy is a good idea (or at least a neutral one) then the current housing slump and unemployment crisis are irrelevant to the health of the nation --- as long as the government doesn't expect you to kick in more to keep these people from being forced to accept falling wages and a much lower standard of living. If that happens you might not be able to buy as many jewels and fine art and then the whole thing falls apart.

The writer did offer one little warning about the potential problems that might stem from that:

The author of the piece did offer a teensy little warning back in 2007:

Of course, Kapur says there are risks to the Plutonomy, including war, inflation, financial crises, the end of the technological revolution and populist political pressure.I might have thought that the destruction of the middle class would be considered a primary risk for social unrest, but perhaps society's winners think they can protect their jewels and mansions by hiring Blackwater these days, so it's not a problem. In any case he brushed off all those potential consequences:

Yet he maintains that the “the rich are likely to keep getting even richer, and enjoy an even greater share of the wealth pie over the coming years.”It would appear that even in the aftermath of a near cataclysm in the financial sector, they have not changed their minds. But then, why would they? From their perspective, the government did its job by bailing out the big banks and Wall Street to save the economy and everything's back to normal.

All of which means that, like it or not, inequality isn’t going away and may become even more pronounced in the coming years. The best way for companies and businesspeople to survive in Plutonomies, Kapur implies, is to disregard the “mass” consumer and focus on the increasingly rich market of the rich.

There are still those that had and still have, and continue to expect to have more, and are the only people in this nation with any real money to spend... Too bad for us that it is our money, and our government too, they have completely consumed.

But the rest of us have even less than we did before... And can expect to lose even more than we have already lost over the last 20 or 30 years. The haves are currently sitting on their pile of money in the hopes of driving wages down even more. And as long as they don't create jobs the demand for you continues to shrink. That is reality.

Why not? They can afford to. Can you afford to just sit there and watch your way of life and what used the American dream get flushed down the drain?

If we continue to do nothing all we'll have left is this Open Thread. Hope it does not leave a bad taste in your mouth!

And some more stuff, previously posted at ePM, for the rest of us have nots to choke on:

--------------

How Can Tax Cuts Make This Pile Of Money Trickle Down?

They've got their massive piece of the pie... And they want more.Seriously? They are already hoarding vast sums of money - probably trying to figure out how to offshore it with our jobs too - and the GOP plan, the highly desired plan of corporations and the their rich owners, is giving them more with tax cuts for the listless elites. That will just be a bigger welfare check than the ones we already floated Wall Street for doing absolutely nothing to fix the disaster they created.Corporations Sitting On $1.84 Trillion Cash

From last month: U.S. Firms Build Up Record Cash Piles,

The problem is reduced demand. Continuing unemployment means that the economy is not producing demand, so businesses are not willing to risk investing in meeting demand, which means they are not hiring, which means unemployment continues.U.S. companies are holding more cash in the bank than at any point on record, underscoring persistent worries about financial markets and about the sustainability of the economic recovery.

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952.

Meanwhile, the screech of the typical village idiot corporate shills and deficit peacocks is getting shrill:

Those Deficit Peacocks won't dare look at what is really creating the deficits and what would really get more people back to work.Arguments From Authority

A quick note on David Brooks’s column today. I have no idea what he’s talking about when he says,

The Demand Siders don’t have a good explanation for the past two yearsFunny, I thought we had a perfectly good explanation: severe downturn in demand from the financial crisis, and a stimulus which we warned from the beginning wasn’t nearly big enough. And as I’ve been trying to point out, events have strongly confirmed a demand-side view of the world.

But there’s something else in David’s column, which I see a lot: the argument that because a lot of important people believe something, it must make sense:

Moreover, the Demand Siders write as if everybody who disagrees with them is immoral or a moron. But, in fact, many prize-festooned economists do not support another stimulus. Most European leaders and central bankers think it’s time to begin reducing debt, not increasing it — as do many economists at the international economic institutions. Are you sure your theorists are right and theirs are wrong?Yes, I am. It’s called looking at the evidence. I’ve looked hard at the arguments the Pain Caucus is making, the evidence that supposedly supports their case — and there’s no there there.

And you just have to wonder how it’s possible to have lived through the last ten years and still imagine that because a lot of Serious People believe something, you should believe it too. Iraq? Housing bubble? Inflation?

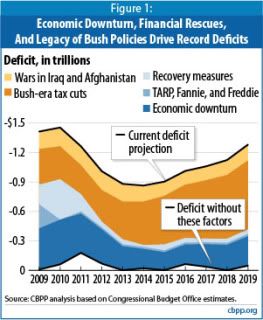

Figure 1 for your reference... And note the heavy costs of tax cuts for the Wall Street Welfare elites and uber rich, the cravenly irresponsible masters of economic disasters that are hiding behind political maneuvering of both parties to destroy any sense of justice in the economic system to keep their gravy train looting the nation:Bush Tax Cuts, War Costs Do Lasting Harm to Budget Outlook

Some commentators blame recent legislation — the stimulus bill and the financial rescues — for today’s record deficits. Yet those costs pale next to other policies enacted since 2001 that have swollen the deficit. Those other policies may be less conspicuous now, because many were enacted years ago and they have long since been absorbed into CBO’s and other organizations’ budget projections.

Just two policies dating from the Bush Administration — tax cuts and the wars in Iraq and Afghanistan — accounted for over $500 billion of the deficit in 2009 and will account for almost $7 trillion in deficits in 2009 through 2019, including the associated debt-service costs. [6] (The prescription drug benefit enacted in 2003 accounts for further substantial increases in deficits and debt, which we are unable to quantify due to data limitations.) These impacts easily dwarf the stimulus and financial rescues. Furthermore, unlike those temporary costs, these inherited policies (especially the tax cuts and the drug benefit) do not fade away as the economy recovers (see Figure 1).

Without the economic downturn and the fiscal policies of the previous Administration, the budget would be roughly in balance over the next decade. That would have put the nation on a much sounder footing to address the demographic challenges and the cost pressures in health care that darken the long-run fiscal outlook.

A huge swath of tangerine dream green handed to them on a silver platter in tax cuts that far and away benefited the rich and the GOP side is publicly voicing support for these evident do-nothings of the economy to keep from paying their fair share at the exact time that all of America is suffering these elites' disaster.

Nevermind the Pelosi's of the world pretending to be against dropping the budget hammer on you while putting in place the very real means to run over the small people's social safety nets with "procedural votes" behind closed doors.

And that is supoosed to be liberal leadership? Give me a corporatist break!

This is a war of ideals, one that the real people have been losing for far too long:

Anyone who thinks the unemployment situation is a product of poor governing on the part of this President can't recognize a class war when they see it. The real issue on the table here is corporate power and control.And while Wall Street throws itself a faux pity party:

Consider the recent Luntz-style attacks on the unemployed. Rather than addressing the reasons for the stubbornly high unemployment rate, they choose to demonize those who are unemployed.

We're too stupid, too lazy, or we want to be paid too much to rehire.

Of course, none of these things are true, but they offer cover for CEOs to duck the true questions about why they'd rather simply sit on the cash and forego expansion for now. They'd rather do it because they can. Because they can afford to wait until they have a puppet in the oval office who will do their bidding, who will call off the regulatory dogs, and who understands unique corporate challenges.

No kidding that it is unseemly. It is beyond obscene given that it is clear that a lot of the regulatory changes to the finanacial industries are highly illusory.Wall Street's pity party snit fit

Anonymous bankers complain to Politico that Democrats did not do enough to soften bank reform

Imagine two alternate realities. In one universe, the bank reform bill likely to be signed into law in the United States is generally regarded by critics as not quite up to the task of delivering on its primary goal: preventing a repeat of the financial crisis that broke the global economy in 2008. In this universe, there are differences among those who believe that the bill, while manifestly imperfect, still represents an improvement on the status quo, and those who dismiss it as irredeemably irrelevant, but there is nonetheless a widespread consensus that resistance from Republicans and moderate Democrats, in combination with a cautious White House, resulted in legislation that is much milder than what would seem to have been called for under the circumstances (a devastating economic collapse precipitated by recklessly irresponsible financial institutions.)

Now let's visit another universe, one constructed from anonymous comments relayed to Politico reporters from enraged Wall Streeters. In "Wall St. Plans Payback For Reg Reform," we learn that there is a "great deal of frustration" being felt by bankers towards Democratic politicians who have the gall to come to Wall Street asking for money, after having dared to vote for bank reform.

While the final Wall Street reform bill turned out to be less onerous than banks feared, there are still hard feelings, especially over the rhetoric used to slam banks such as Goldman Sachs, Morgan Stanley and JPMorganChase...HTWW agrees with the bankers on one count: It is indeed "unseemly" for politicians to be soliciting Wall Street for campaign contributions while at the same time carving out the final shape of bank reform.

... Still, feelings in the financial industry are very raw, especially toward moderate and New York-area Democrats who, the industry feels, did not do enough to ease the potential impact of the financial overhaul.

And much of the continued fight is to keep the country from sliding any faster into the corporatocracy deep end, we have to remember that we are fighting hugely powerful interests that will spend millions to fight any regulation - even the laws that have been in place for years - in order to grease the slippery slope and even if the fight's cost dwarf the minute penalties from enforcement of legislation:

The people we are fighting against have the big money guns and they control the strings of every corporate puppet at every level of government, at every turn of the traditional media's corrupted phrases... And they are liars.Wal-Mart spends $2 million fighting $7K fine

The Death Star of American corporations, Wal-Mart, has decided to contest a minor fine from OSHA. In doing so, the Arkansas based company has amassed $2 million in legal fees, according to the NY Times.

The $7,000 fine from OSHA was for the trampling death of a Wal-Mart employee , crushed by a surging mob of customers outside a Long Island Wal-Mart the day after Thanksgiving, 2008.

And BTW, they are using Teabagging Konstatooshunull Lawe (sic) to argue, OSHA lacks the authority to issue fines in the first place

The only thing we do have on our side is the sheer numbers of real people to effect change. And the occasional Financial realists that are already in a position to advocate for what they know is the right thing to do, both morally and fiscally. Yves there, at Naked Capitalism, echoing thoughts of the Financial Times' Martin Wolf:

Wolf next establishes that the private sector in countries all around the world is saving. The OECD forecasts that savings in advanced economies will be 7% of GDP, or roughly $3 trillion. In theory, these savings could go to investments in emerging economies, but the private sector in those countries is projected to be saving too. The Institute for International Finance anticipates a total of $300 billion for 2010.Meanwhile? We will still have to listen to absolute drivel coming out of a failed incoprporated system of government for the corporation, of the corporation and by the corporation:

Wolf then explains how this all plays out:

According to the IIF, the net flow of private funds from advanced countries to emerging countries will be close to $700bn this year. But that will be almost entirely offset by an official outflow, in the form of foreign currency reserves, of close to $600bn. These huge official interventions prevent the emergence of large net capital inflows into emerging countries. Instead, the private sectors of the advanced countries accumulate net claims on the private sectors of emerging countries, while the governments of emerging countries accumulate offsetting claims on the governments of advanced countries.Yves here. So Wolf, and the Bank of International Settlement (hardly a bunch of socialists) think keeping old people from having to subsist on pet food would be good for economies around the world. I’d love to see Wolf up against the Social Security fear mongers from the Peterson Foundation. Fur would fly.

The bottom line is clear: there exists, at present, a gigantic net flow of funds into the liabilities of the governments of advanced countries. Of course, some countries can still get into difficulties. But it is quite wrong to argue that the difficulties of a Greece or a Spain entail difficulties ahead for the US, or even the UK. The opposite is far more likely: flight from risk entails flight into something less risky. What is the least perilous asset for the investment of gigantic private financial surpluses? The only answer is the public debt of the big advanced countries.

These flows of funds consist only of identities. So what are the causal factors? Maybe, the collapse in private spending in the wake of the financial crisis was caused by terror of the fiscal deficits to come. Maybe, the moon is made of green cheese, too. There is also next to no sign of crowding out in capital markets. The plausible hypothesis, then, is that the fiscal deficits were a response to the collapsing desire to spend of the crisis-hit private sector. Fiscal policy could have been tighter. But the result would have been a depression.

What then of the future? Suppose there is no significant change in policy in emerging economies. Then if a fiscal contraction in advanced countries is not to cause a slowdown, even a second recession, it must be accompanied by an upsurge in private spending.

The argument must be that improved confidence in the long-run sustainability of public finances would lead to greater private consumption and investment spending now, even if there is no significant effects on interest rates or the exchange rate. I am highly sceptical of this argument (see “Why it is right for central banks to keep printing”, Financial Times, June 22, 2010). But grant that this is true. Then the best policy is to slow the long-term growth in spending on age-related programmes. This comes out clearly from the discussion of long-term fiscal trends in the excellent new annual report from the Bank for International Settlements.

So I was watching a CNN panel today and the subject up for debate was something along the lines of, "Is Obama shedding constituents? Critics say he's abandoned Wall Street."Yes... Via CNN we get the ultimate circular firing squad of "Leave the rich alllooooone!"

My first reaction was, "Wait, critics are saying this? Are you sure that wasn't what his allies said?" But no -- I actually had to listen to a debate over whether Obama was making a huge political mistake by "abandoning" his bestest pals in the world at the megabanks.* You know, the guys whose greed and irresponsibility caused the worst financial collapse since the Great Depression.

(*Obama hasn't actually "abandoned" the banks in the least, but that's a story for another post.)

And then I thought, "Why the hell are we the only culture in the whole goldurned world where it's seen as a political risk to abandon the people who are responsible for causing widespread economic hardship?" And all this got me thinking about the super-weird "We-Must-Be-Nice-to-Rich-People" doctrine that has run through our national discourse since the 1980s.

You see, there was a time when American politicians could say things such as "It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes" (Andrew Jackson) and "Too much cannot be said against the men of wealth who sacrifice everything to getting wealth" (Teddy Roosevelt) and "We had to struggle with the old enemies of peace — business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering... They are unanimous in their hate for me — and I welcome their hatred" (FDR) and no one thought anything of it. Indeed, as Simon Johnson and James Kwak show in their excellent book 13 Bankers, hating on financial oligarchs is as American as hating on soccer, dating all the way back to Thomas Jefferson.

The problem with their table talk? Joe and Suzy Sixpack's livelihoods, their ability to just scrape by during the elites disaster capitalism coupled with looting the nation crime sprees, are the roadkill carcasses they will gladly dine on to continue take their money for nothing.

I'd say that rather than giving the elites a bigger piece of the splattered, half-baked schemes of gambling casino pie in the sky... It is long passed time to let them have their own medicinal cake of austerity, tightening their fat elitist buckles.

But eating any cake is too good for the masters of economic disasters that want more welfare for the rich and consider pissing on you, the poor, as trickle down.

The slogan for today's real populism ought to be a well deserved:

Save America - Eat the rich.

Lead the financial sycophants and their listless do-nothing way of life to the slaughter. Because it is clear it is either going to be you or them... And lord knows the rich don't want to be held responsible for their gambling habits, their crimes and their their failures.

As a side note: If you aren't already mad as hell about this shit-salad-sandwich that we are being force fed daily, then I do question your sanity.

--------------

Please chalk this whole post up the little voice inside my head that is screaming:

"WE'RE DOOMED!!!!"Some noteworthy pieces, IMHO, to go with this: